2010 Election Snapshot

ALP Mining Tax Policy

-

Summary

Presently, a royalty system exists to charge miners for extracting resources but has not kept pace with the dramatic increase in world minerals resource prices over the last 10 years. As of last year, miners paid an effective tax rate of 18% of their profits. Due to these being non-renewable national resources belonging to all Australians, the ALP sought to increase the tax on profits of iron ore and coal miners. In order to reach the recent agreement with miners, the ALP has made significant concessions, but in light of revised government forecasts the concessions made appear to have diminished. The mining tax still needs to receive passage through the Senate; this will have to wait till after the election.

More

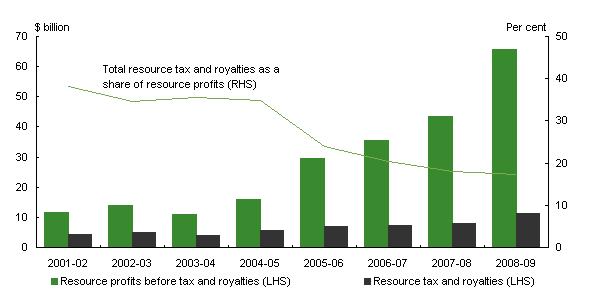

The ALP suffered significant barrage from the mining industry when Kevin Rudd introduced the original Resources Super Profits Tax at 40% in May 2010. Miners until then had enjoyed an ineffective royalty scheme which had simply not kept pace with the explosion in international resource prices over the past 10 years in particular. Where 10 years ago miners paid an effective tax rate of up to 50% under the royalty scheme, with the subsequent increase in demand for mineral resources emanating largely from China, under today’s high prices miners are now paying a mere 18% tax.

With the events of the Global Financial Crisis of 2008, Australia was and is particularly well placed by comparison to her peers, yet large spending to stimulate the economy was affected and the inevitable budget deficit must now be addressed. Accordingly, while the mining sector has avoided scrutiny with respect to tax reform during the Howard government, a revised measure of taxation is now inevitable. Along with a much needed introspection of broader Australian taxation, the government commissioned the Henry Tax Review in May 2008, which was released in May 2010. As comprehensive as this review was, a number of recommendations were made by Doctor Henry however, not all of them are being implemented right now. Apart from company tax, superannuation entitlements and the mining tax, they appear to be largely subject to digestion over subsequent years. Indeed, profound studies of this kind tend to endure for the benefit of subsequent governments.

The ALP has however, have been keen to implement some of the observations of the Review; that the mining industry appears to be paying a far less proportion of its profits under the royalty scheme due to the strong growth in the Chinese economy and the significant increase in world resource prices that have occurred during the last decade. While initially seeking to apply a 40% retrospective tax on profits, the government were prepared to provide 40% of the costs of a project, and also fund extensive mining infrastructure.

The mining industry reacted adversely and collected a war chest of some $100m to promote their cause in a national media campaign. Discussions under the Rudd government were held with miners but negotiation was not forthcoming. The government at that stage of June 2010 was flexible on implementation it seemed, but immovable on the 40% headline rate; a veritable millstone to the miners. Numerous sectors of Australia were enlisted into the debacle. Many were concerned about small business in their local economies with miners threatening to cancel future projects due to the effects of the tax on investment. Some were concerned about their jobs. The media took to the debate with gusto, and fuelled by the miner’s aversion to the tax, the Coalition stated that miners pay enough tax through present arrangements in the royalty scheme.

The government suffered large swings in national polling. That this was occasioned by the mining tax or other matters is inconclusive, if not unreliable. Quite simply, on the 23rd July 2010 the Labor caucus expressed a desire to support a varied approach and chose to support an alternate Executive in the Lower House; Julia Gillard. On 24th July 2010, with Kevin Rudd relegated to the back bench, the new Prime Minister was swift to affect negotiation and compromise with the miners over the next few days. Rapid progress was made with the tax being renamed from a Resources Super profits Tax (an economic term of some Marxist influence), to a Mining Resources Rent Tax. The headline rate was reduced from 40% to 30%, the threshold for the tax to take effect was raised from 6% or the bond rate, to the bond rate plus 7% (and $50m), mining infrastructure paid for by government remains to the tune of $6bn over 10 years, but the original retrospective operation of the tax was removed. Further, a 25% extraction allowance has been extended to miners. Representing 75% of Australia’s resources industry profits, the scope of the tax was narrowed to include only iron ore and coal miners. Needless to say, mining projects were quickly rescheduled and corporate mining was pleased.

Further discussion on implementation is yet to take place, but accord has been reached between the government and the largest miners, BHP, Rio Tinto and Xstrata. The proposed tax is also yet to receive passage through the Senate where it will no doubt come under some scrutiny from Senate Committees. Revenue generated by the tax was initially said to be $12bn, but concessions, once forecasted resource prices are incorporated, represent a compromise of $1.5bn.

This $10.5bn revenue from the MRRT will fund $5.5bn of mining infrastructure, affect a 1% reduction in company tax, and assist in a promise to increase the superannuation guarantee from 9% to 12% over 6 years to 2019. It is of note that Western Australia represents approximately 50% of the entire mining sector in Australia, producing 98% of our iron ore, but does not export coal. That it seems is left to the east coast.